Accounting Services In Singapore

what we do

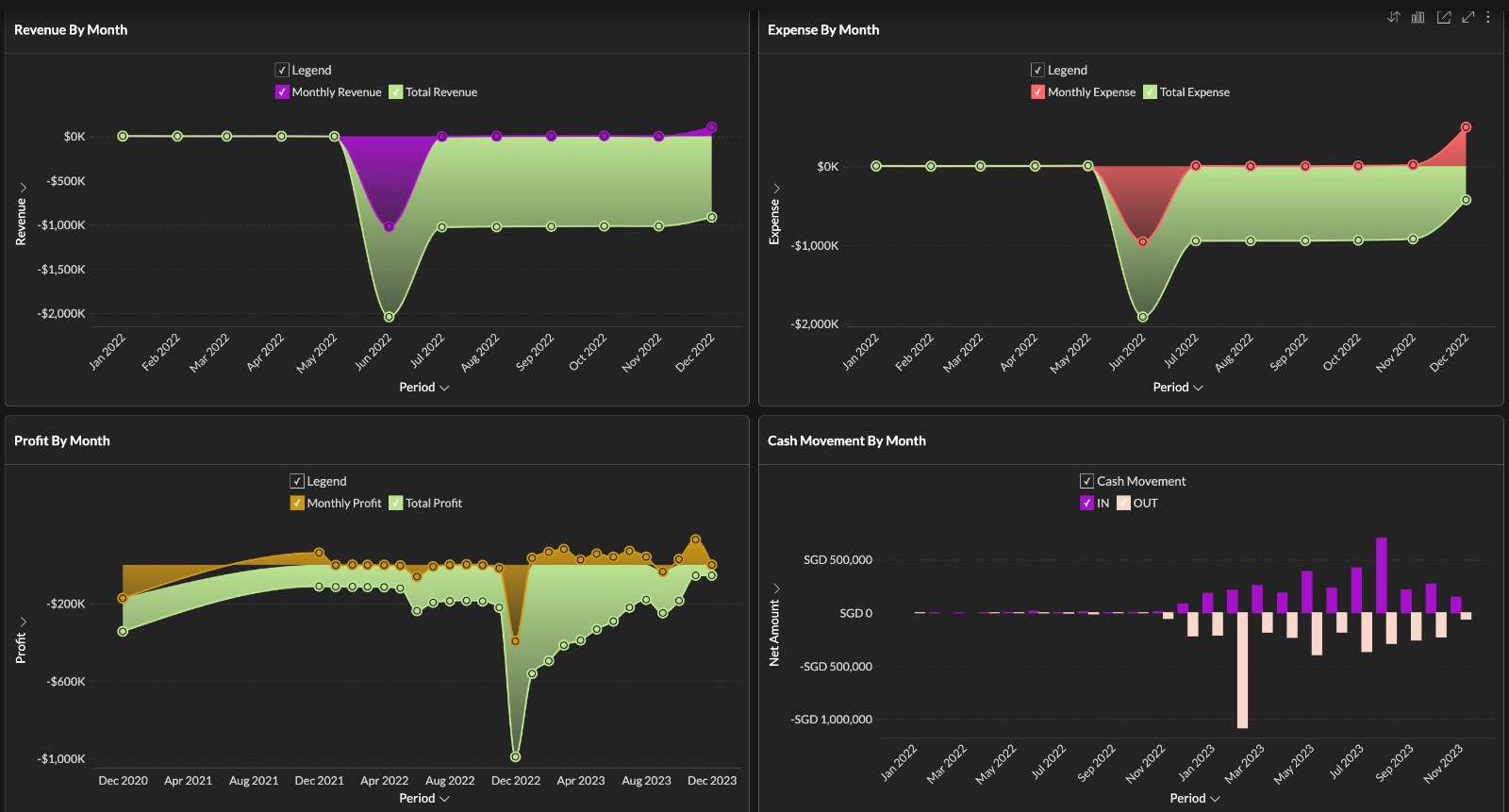

Gain Complete Insight Into Your Financial Landscape

Personalized Help

we give you custom financial advice. Our team works closely with you, offering personalized strategies that match your business goals.

Expert Bookkeeping

We’ll take care of your financial statement, taxes, transaction matching, and billing.

Cloud Tools

We use the latest technology for easy accounting. With Heysara, you get user-friendly software and guidance to make smart decisions quickly.

Easy Compliance

We make following financial rules simple. Heysara manages rules and keeps things accurate, helping your business run smoothly.

WHY Heysara

Empower Yourself With Complete Financial Command

Expert Team Assistance

Strict Compliance Reminders

In Singapore, compliance is crucial. We ensure you stay on track by timely reminders for tax, GST, and other governmental submissions. Trust us to keep you informed and compliant with all deadlines.

Effortless Financial Management With FAST App

Got questions?

Chat with our local experts

Access your cash flow information instantly through our FAST APP. Utilizing these metrics, we’ll generate comprehensive reports, illustrating the sources of your income and where your expenditures lie.

STEP BY STEP

Our Cloud Accounting Framework

We have perfected our Cloud Accounting Framework, by leveraging on the use of intelligent cloud Accounting Solution, our own Productivity tools & Analytics Solution. As a result, we are able to simplify our efforts so that we can pass the bulk of our cost savings back to you.

Packages for Accounting & Bookkeeping

Monthly Bookkeeping

From$200 / Month

What Do I Get

- Perform bookkeeping and verify client’s data and documents

- Clients invoice/expenses/receipts to be electronically transmitted to us using our Mobile Expense App

- Perform Bank Reconciliation

- Preparation Monthly Management Report

- Cloud Accounting Software Subscription Excluded

- GST Computations And GST Filing + $300 Per Quarter

Annual Compliance Package

From$1,600 per Annum

What Do I Get

- With Book-keeping Service For up to 120 Transactions.

- Prepare Unaudited Financials Statement Compilation and Simplified Form C/S

Move Your Accounting

to HeySara Effortlessly!

Transitioning your accounting to HeySara is straightforward and hassle-free. Experience simplicity and efficiency in managing your finances. Get in touch with our expert now now!

Frequently Asked Questions

Accounting refers to the recording of transactions in books of accounts. This process will help you ascertain the correct profit or loss and position of assets and liabilities as on a date and for a period. Taxation refers to the process of determining your liability to collect and pay taxes. It also involves filing of tax returns with the Inland Revenue Authority of Singapore (IRAS).

All Singapore companies are required to file tax compliance in accordance to their business structures. Failure to do so may lead to government fines and penalties. If you are uncertain of your tax obligations, feel free to contact us for a free consultation.

All Singapore companies are require to submit 2 corporate income tax returns annually – Estimated Chargeable Income (ECI) within 3 months from financial year end and Corporate Income Tax Return (Form C/C-S) by late November or early December via e-filing. Exceptions are made to companies who are qualify for ECI waiver or granted Waiver of Income Tax Return Submission by IRAS. If you are uncertain of your tax obligations, feel free to contact us for a free consultation.

Yes you can! And the best part, you don’t need to do a thing! We will make the transfer easy and hassle-free. We will personally contact your current provider, take over all the documents and register and process the necessary paperwork. Even if your former accountant do not respond, the procedure can still proceed smoothly. Either way, just sit back and rest, knowing your accounting work is in good hands.

Read our most popular guides on getting started

Find out more about company secretary services

Importance of Corporate Service Providers in Company Incorporation in Singapore

Ready to launch your business in Singapore? Engage a trusted Corporate Service Provider today to ensure a smooth and compliant start.

Industry Deep Dives: Sectors Set to Thrive in Singapore

HeySara stands out as a leading technology-driven corporate service provider, delivering tailor-made solutions to startups and SMEs in Singapore.

Singapore Economic Outlook 2025: Growth Prospects, Challenges, and Opportunities for Businesses

HeySara stands out as a leading technology-driven corporate service provider, delivering tailor-made solutions to startups and SMEs in Singapore.