Accounting & Tax Services for Singapore SMEs

Quick Facts for Accounting & Tax Compliance

- Bookkeeping: Monthly or annual options

- Corporate tax filing: Form C, C-S, or C-S (Lite)

- GST filing: Quarterly F5 submissions (add-on included in packages)

- Record-keeping: Minimum 5 years (IRAS rule)

- Software supported: Xero, QuickBooks

- Turnaround: Monthly bookkeeping report; annual financial compilation

what we do

Personalized Help

We give you custom financial advice. Our team works closely with you, offering personalized strategies that match your business goals.

Expert Bookkeeping

We’ll take care of your financial statement, taxes, transaction matching, and billing.

Cloud Tools

We use the latest technology for easy accounting. With HeySara, you get user-friendly software and guidance to make smart decisions quickly.

Easy Compliance

We make following financial rules simple. HeySara manages rules and keeps things accurate, helping your business run smoothly.

Transparent Accounting Packages

Monthy Bookkeeping

- Bookkeeping & data verification

- Bank Reconciliation

- Monthly management report

- Add on: GST Computations and GST filing +$300/quarter

- Cloud accounting software subscription excluded

Annual Compliance Package

- Bookkeeping for up to 120 transactions

- Preparation of unaudited financial statements

- Simplified Form C-S filing

- Add on: Extra bookkeeping or GST filing as needed

Why HeySara

Expert Team Assistance

Strict Compliance Reminders

In Singapore, compliance is crucial. We ensure you stay on track by timely reminders for tax, GST, and other governmental submissions. Trust us to keep you informed and compliant with all deadlines.

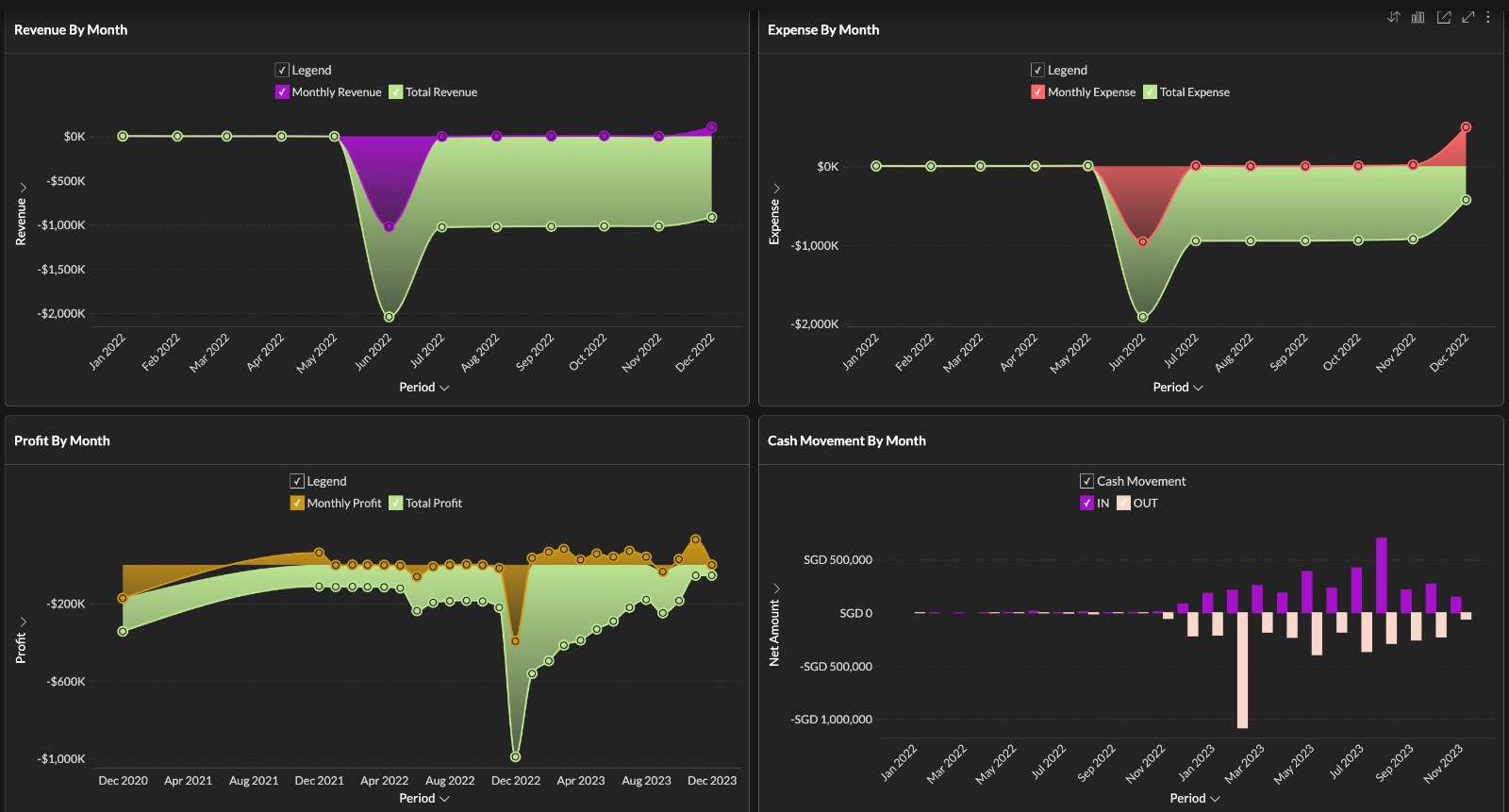

Effortless Financial Management With FAST App

Got questions?

Chat with our local experts

HeySara handles your bookkeeping, tax filings, and IRAS compliance accurately and on time, so you can focus on running your business. Get expert support tailored to your stage—startup or SME. Speak to us today for a free, no-obligation accounting consultation.

STEP BY STEP

Our Cloud Accounting Framework

We have perfected our Cloud Accounting Framework, by leveraging on the use of intelligent cloud Accounting Solution, our own Productivity tools & Analytics Solution. As a result, we are able to simplify our efforts so that we can pass the bulk of our cost savings back to you.

Frequently Asked Questions (FAQs)

Read our most popular guides on getting started

Find out more about our services