Looking to establish a non-profit organization in Singapore?

Why choose a Company Limited by Guarantee (CLG)?

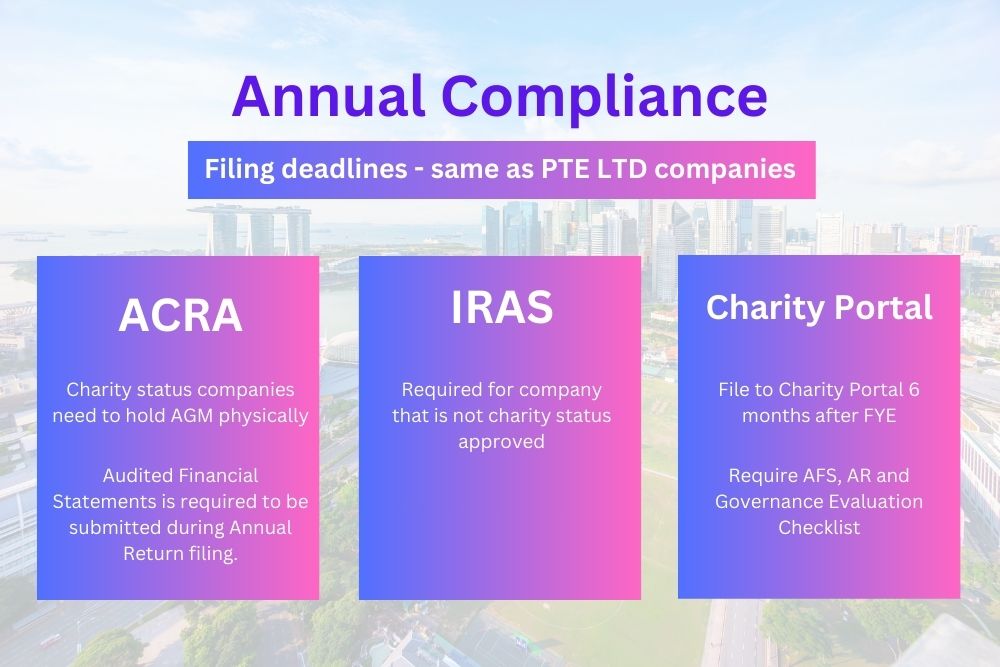

Basic Compliance Requirements:

- The CLG’s governing board must comprise a minimum of three members.

- Articulation of the organization’s goals and objectives, delineating the desired achievements within the entity, is essential.

- A registered office address within Singapore is necessary for official communications and notifications.

- Compliance with the Companies Act and other relevant legislation overseen by ACRA is obligatory.

- Within three months of establishment, the CLG must engage the services of a company auditor.

- A company secretary must be appointed within six months of incorporation.

- Annual tax returns must be submitted to IRAS by 30th November.

- Annual returns must be lodged with ACRA within 30 days following the annual general meeting (AGM).

Tax Exemptions:

- Companies limited by guarantee (CLGs) are subject to corporate tax at the prevailing rate of 17% on their chargeable income unless they meet the criteria for tax exemption.

- To qualify for tax exemption, a CLG must fulfil specific conditions and secure charity status from the relevant authorities. The application for charity status can be submitted via the Charity Portal.

- Qualifying conditions include registration as a charity with the Commissioner of Charities (COC) or as an Institution of a Public Character (IPC) under the oversight of the relevant Sector Administrator (SA).

- The CLG must exclusively pursue charitable objectives that benefit the broader community in Singapore, avoiding any narrow or sectional interests.

- Utilization of income and assets should be solely dedicated to charitable purposes, with no distribution to members.

- Adherence to regulatory requirements set forth by the COC, SA, Accounting and Corporate Regulatory Authority (ACRA), and Inland Revenue Authority of Singapore (IRAS) is mandatory.

Our Fee Guide

Incorporation Package for

Company Limited by Guarantee (CLG)

Quick Starter

Incorporation + 1-Year Named Secretary + 1st AGM/AR + Govt Fees included

$1,688nett

What Do I Get

- Company Registration Service

- ACRA Government Fee $315

- Secretary Package (12 Months)

-

All Incorporation Documents

- ACRA Company Profile

- E-Notice of Incorporation

- 1st Directors’ Resolutions

- 1st RORC Registration

Our comprehensive services includein 3 simple steps

Consultation

We provide expert guidance on choosing the right structure for your non-profit organisation set up and fulfilling regulatory obligations.

Document preparation

Our team assists in preparing all necessary documents for the incorporation of the Non-profit organisation.

Submission

We handle the submission of your charities' registration documents to the Accounting and Corporate Regulatory Authority (ACRA).

watch our video your journey with us begins here!

Additional services you might need

Get your company registered, bank account opened along with all compliances sorted for the year ahead with the click of a button.

Annual Return Filing

Company Registered Address

Every Singapore company is required by law to have a valid Singapore address as registered address of the company.

Read more here

CorpPass Registration

Required for online corporate transactions with the government (SingPass is also required).

OCBC Start Digital Pack

Discover bundle solutions for starting a business

why choose Us?

100% Online

24/7 Cloud Access

Say goodbye to the limitations of traditional office hours. Embrace unparalleled freedom and efficiency as you tap into a world where corporate secretary services isn’t tethered by location. Whether you’re on a business trip, working from home, or need to address an urgent matter during off-hours, our

HeySara App ensures you have secure access to all your company’s essential data.

No Hidden Charges

Digital Signature

Data Protection

Pocket Secretary Apps

Want to migrate your secretary to us?

More than a filing agent, we are your lifetime business partner

Organisation of Documents

Timely Reminders of deadlines

Adding in the human touch

24/7 round the clock open communication

Trusted by Heysara around the world

Frequently Asked Questions

At least one member, a registered office address in Singapore, and at least one resident director are required to form a CLG and set-up a Non-profit organisation.

Once you set-up charities, the board of directors is responsible for the management and governance of the CLG, ensuring compliance with laws and regulations, and fulfilling the organization’s objectives.